How to find out your credit options (credit rating)?

In order to receive a loan for your spending needs, you must complete a credit rating application and receive a loan offer. This can be done in Online banking or website (in case if you have no Online banking access or you are not Citadele customer, but you have other authorization devices available).

1a. Through the online bank, application form is available on the home page under Credit Rating.

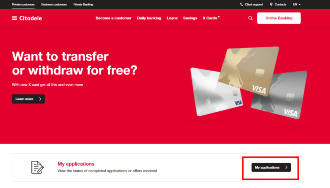

1b. Through the website under Private Customers> Loans > Credit rating > Find out.

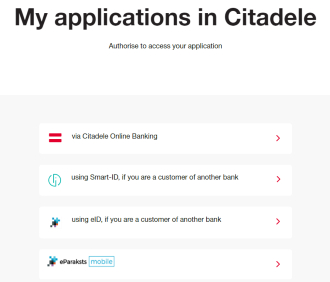

Before filling in the application, choose the most appropriate type of authorization.

2. In the application form, please fill in your most current information, including monthly income, monthly loan payments, required loan sum and other information requested.

3. After filling in your application, confirm that you agree for your data to be processed and that we can request your information from the State Social Insurance Agency. When you agree, you will not have to submit any additional data from the SSIA.

4. Your application will be processed within a few minutes, but please bear in mind that an application which is submitted in the evening or at night will be processed the next morning.

After we review your application, you will receive a reply with a loan offer or rejection.

To view your offer:

- Go to the online banking under Loans and Leasing and select Loan Offers.

- If you submitted an application through our website and you do not have access to the Citadele online bank, you need to visit Private Customers > My Applications to view your offer.

Loan offers are prepared for each customer individually, and you will see your available loan sum, the products we offer and at what interest rates, as well as the processing fee for each specific product. Each customer is evaluated on an individual basis, and the offer will include the most suitable solution for the customer’s situation. All offers are valid for a limited period of time.

Loan offers are prepared for each customer individually, and you will see your available loan sum, the products we offer and at what interest rates, as well as the processing fee for each specific product. Each customer is evaluated on an individual basis, and the offer will include the most suitable solution for the customer’s situation. All offers are valid for a limited period of time.